Renters Insurance in and around Joplin

Welcome, home & apartment renters of Joplin!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Calling All Joplin Renters!

There's a lot to think about when it comes to renting a home - furnishings, parking options, internet access, house or apartment? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Welcome, home & apartment renters of Joplin!

Rent wisely with insurance from State Farm

Open The Door To Renters Insurance With State Farm

The unexpected happens. Unfortunately, the personal belongings in your rented condo, such as a couch, a guitar and a bicycle, aren't immune to theft or accident. Your good neighbor, agent Kyle Hickam, can help you choose the right policy and find the right insurance options to protect your belongings.

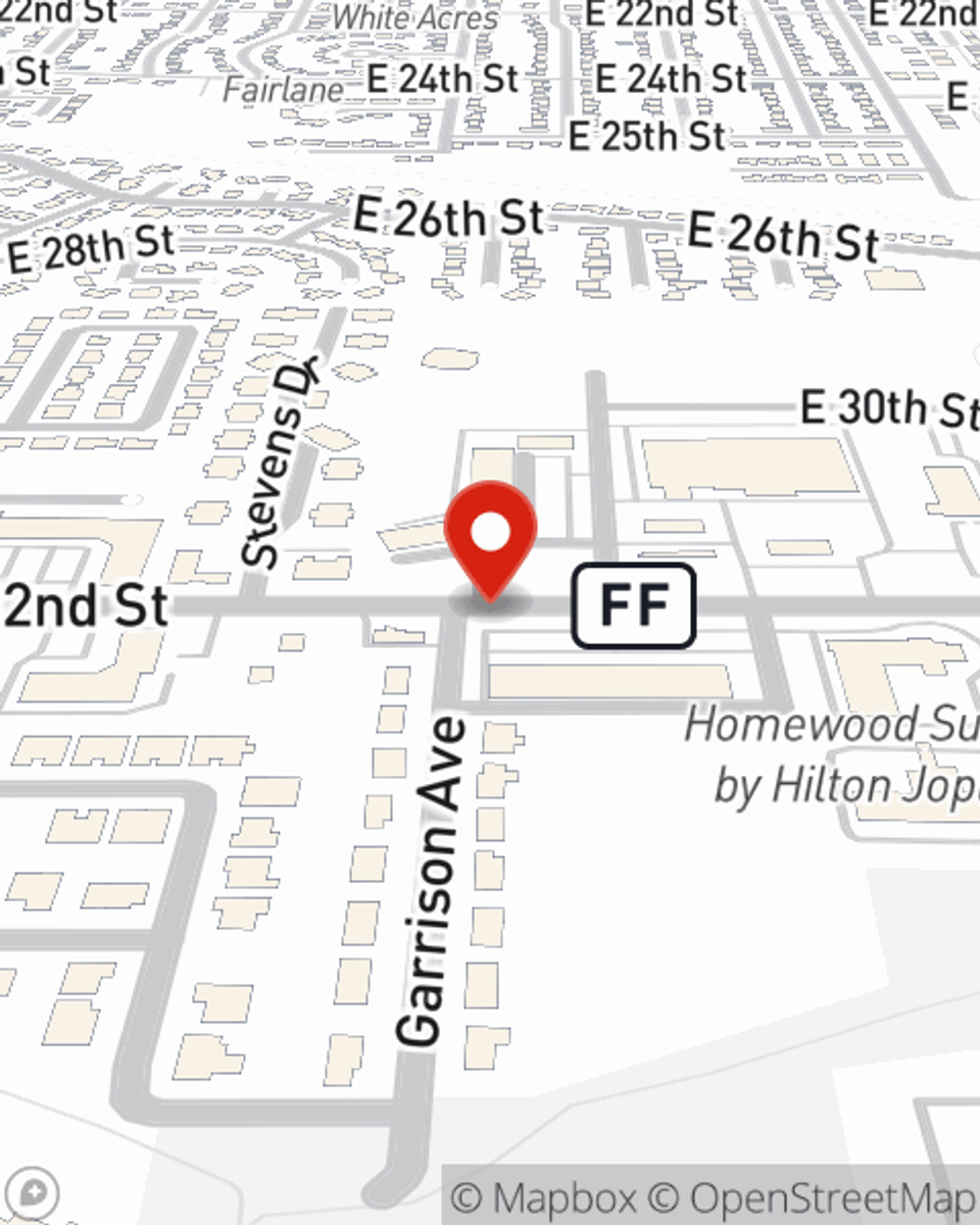

Renters of Joplin, State Farm is here for all your insurance needs. Visit agent Kyle Hickam's office to get started on choosing the right coverage options for your rented property.

Have More Questions About Renters Insurance?

Call Kyle at (417) 624-8443 or visit our FAQ page.

Simple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Kyle Hickam

State Farm® Insurance AgentSimple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.